Company Overview

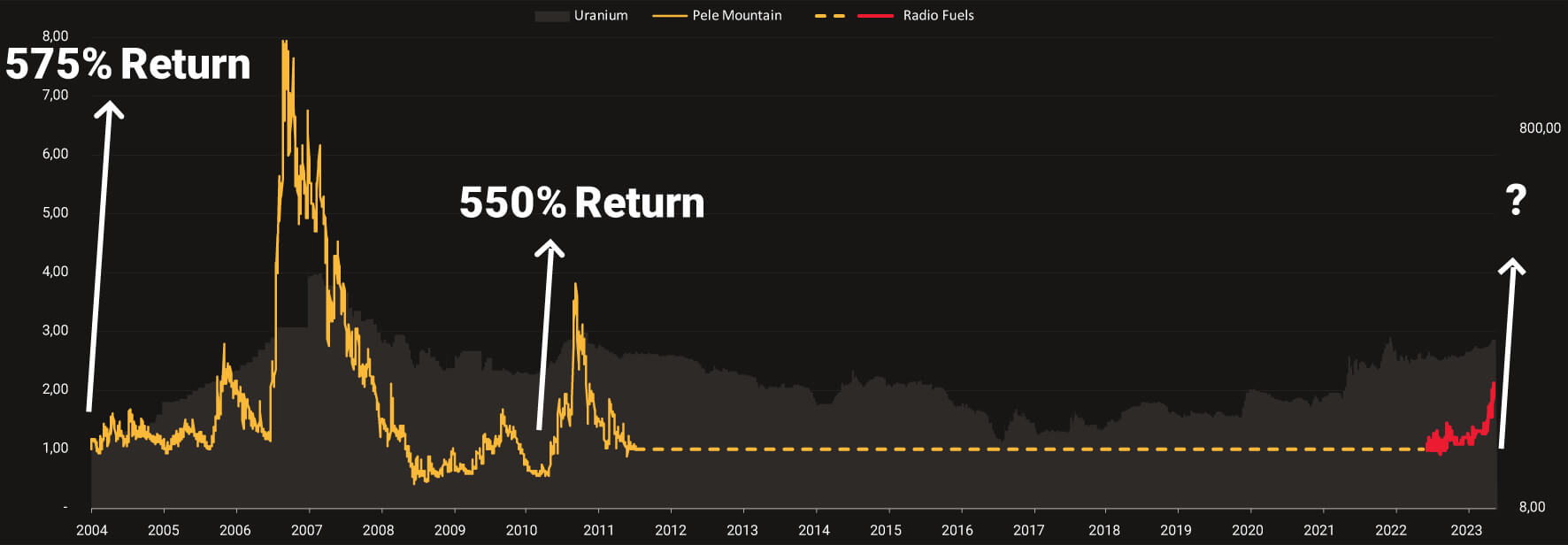

Proven model & project in a uranium cycle

Consolidation and hold is an upheld strategy throughout previous bull markets, providing massive returns to investors

Proven management team

Founded by the same teams behind NexGen Energy (TSX:NXE), Mega Uranium (TSX:MGA), EarthLabs (TSXV:SPOT, SPOFF), and New Found Gold (TSXV:NFG)

Upside to rare earths

Unparalleled leverage to rare earths, with roughly 50% of the uranium resource comprising of rare earth metals

Working capital

Strong working capital balance of $20.7M

Nuclear is ideal for dealing with climate change, because it is the only carbon-free, scalable energy source that’s available 24 hours a day.

I think modern nuclear power plants are safe contrary to what people may think.

Uranium Macro Outlook

Global Demand For Electricity to Grow 76% by 2030

Uranium miners have all curtailed production creating a significant supply/demand deficit

Long-term contracts that were negotiated in the previous cycle are now expiring resulting in utility companies now needing to renegotiate at normalized pricing

Increasing acceptance as an ESG investment and an important source of clean-energy

Continuing low prices have halted the development of new mines causing a lack of replacement supply as older mines come offline

USA

US electricity generated from nuclear power:

World

Worldwide electricity generated from nuclear power:

Reactors

Reactors in number:

Mineral Resource Estimate August 19, 2021

| Classification | Tonnes | U3O8 | Total REO | U3O8 Equivalent | |||

|---|---|---|---|---|---|---|---|

| (000 t) | (%) | (000 lbs) | (ppm) | (000 lbs) | (%) | (000 lbs) | |

| Indicated | 22,306 | 0.045 | 22,290 | 1,613 | 79,314 | 0.081 | 39,920 |

| Inferred | 36,955 | 0.046 | 37,728 | 1,560 | 127,101 | 0.082 | 67,208 |

300+ million pounds of uranium oxide mined.

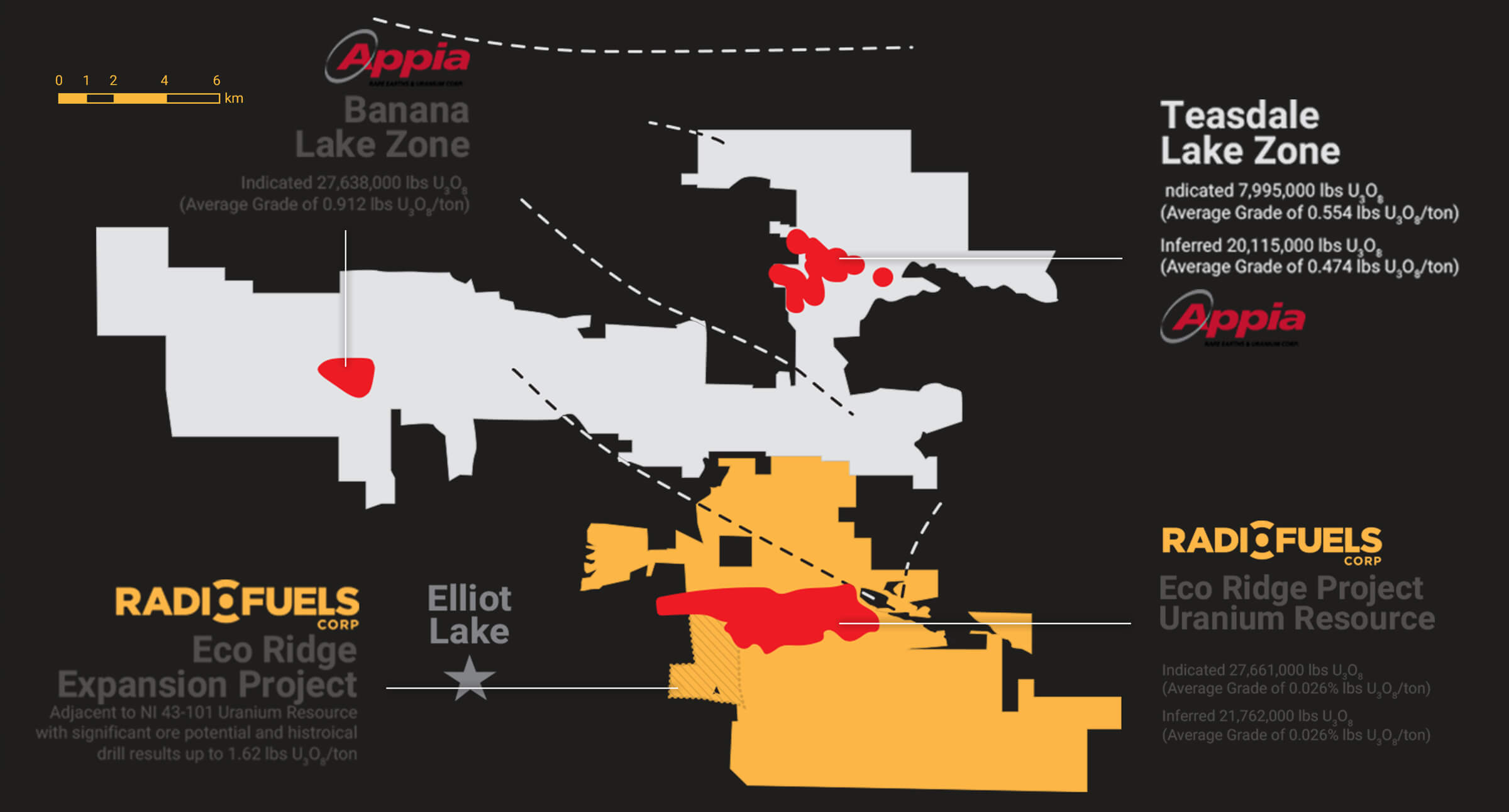

Radio Fuel’s flagship property is its 100-percent owned Eco Ridge Project located in Elliot Lake, where more than 300 million pounds of uranium oxide were mined from conglomerate beds by Rio Algom and Denison Mines from 1956 to 1996.

371 Crown Cell Claims and 4 Mining Leases.

Property consists of 371 Crown Cell Claims and 4 Mining Leases covering a surface area of ~7,800 hectares.

107 historic drill holes drilled between 1953-1974.

107 historic drill holes drilled (~29,000m total) between 1953-1974. Previous owner, Pele Mountain Resources Inc., drilled 232 drill holes (44,000m total) between 2007-2011.

Good standing until the 2030s.

Work carried out by previous owners has accumulated work credits to maintain the Crown Claims in good standing into the 2030s.

Uranium and REE mineralization outcrops.

Uranium and REE mineralization outcrops on surface over a 5-kilometer strike length.

238 Pele Mountain & historic drill holes (44,000m total).

Updated Mineral Resource estimate based on 238 Pele Mountain & historic drill holes (44,000m total). Drilling outlined a resource to a depth of 1,000m along a strike length of 4,000m.

Eco Ridge Expansion

Sault Ste. Marie

Mining Division

The Eco Ridge Expansion Property is located in the Sault Ste. Marie Mining Division of Ontario in Joubin and Gunterman townships.

400 Hectares

Comprises 25 contiguous patented mining claims covering approximately 400 hectares.

$.07 Per Historic Pound

Entered agreement on Dec. 14, 2021, to acquire property for 200,000 shares, or $0.07 per historic pound.

9,744,000 lbs of

contained U3O8

Diamond drilling from 1953-54 by Abeta Mining Corp., and again in 1977 by Lac Minerals outlined a deposit with reported historic reserves of 12,992,000 tons with an average diluted grade of 0.75 lbs U3O8 per ton for approximately 9,744,000 lbs of contained U3O8 (Robertson, 1977).

Historical Resource Estimate* 1977

| Classification | Tonnes | U3O8 | |

|---|---|---|---|

| (000 t) | (lbs U3O8 ) | (000 lbs) | |

| Historical | 12,992 | 0.75 | 9,744 |

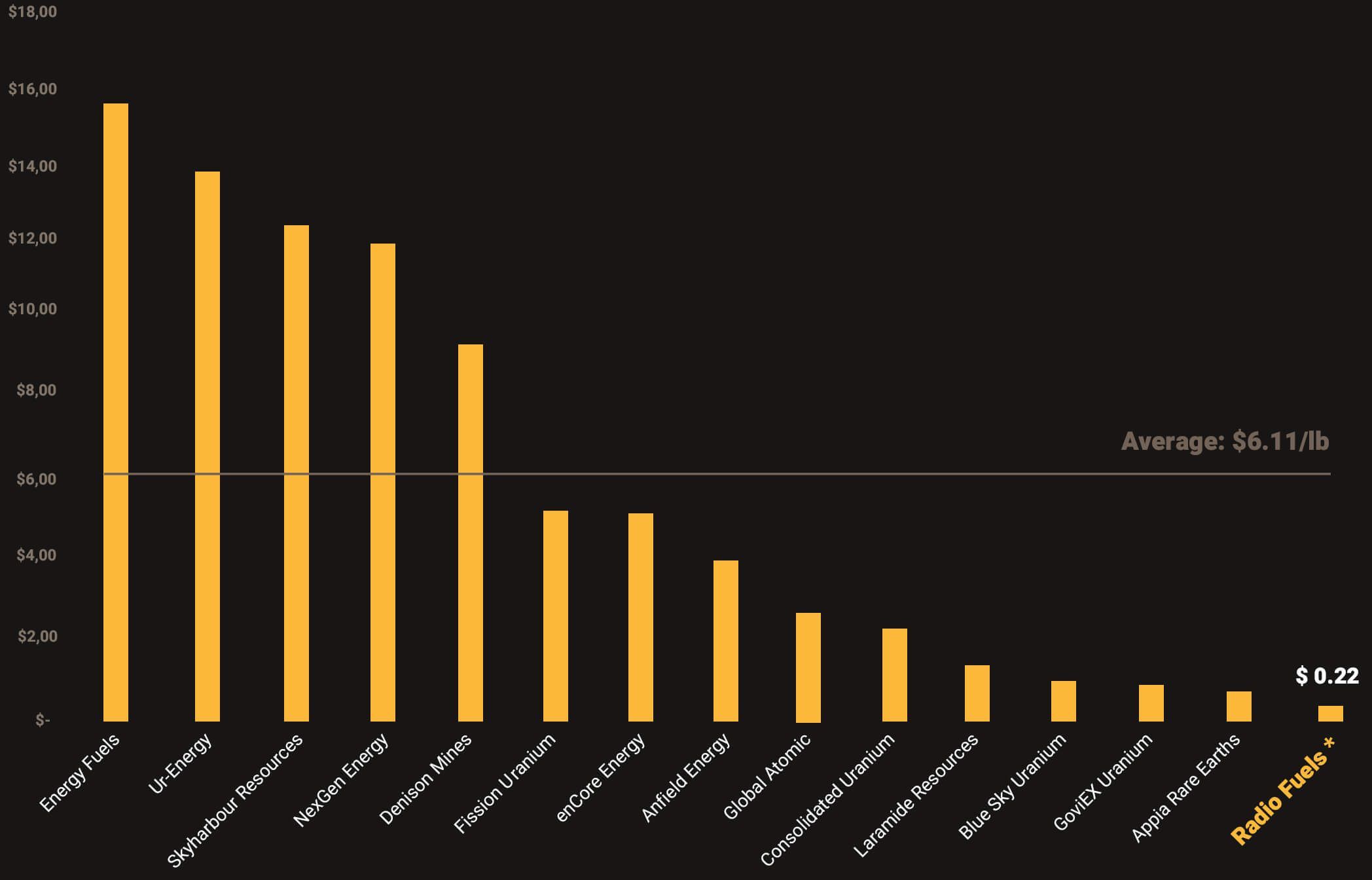

Eco Ridge Resource & Valuation

Compared to its peers, Radio Fuels is the CHEAPEST on a $/lb basis

If Radio Fuels trends towards the average, it can command a $714M valuation, or a gain of 2,600%

Philip O'Neill

CEO & Director

Philip O’Neill is an experienced mining executive and corporate director. He is currently the President and founder of MP1 Capital, a Calgary based investment company created to focus on the natural resources sector. Phil was Director and Chief Operations Officer of Palisades Goldcorp from 2019 to 2021, during which Palisades Goldcorp became one of the most active financiers in the junior mining space. He was also President and Director of Nevada King Gold ahead of its go-public transaction in 2021. In 2010, Phil founded TSX listed Sunward Resources where he held the positions of CEO and Director, raising $81 million in a 10-month span to advance the Titiribi gold/copper project in Colombia. In 2015, Phil negotiated Sunward’s acquisition by NovaCopper, now Trilogy Metals, at a +140% premium to market. Mr. O’Neill has also held directorship roles for several TSX, TSX Venture, and ASX listed companies.

Prior to establishing MP1 Capital in 2006, Phil worked as a research consultant for Casey Research, the publisher of such iconic newsletters as The International Speculator, where he focused on the uranium sector. Prior to Casey Research, Phil worked as a consultant to Jim Dines where he made uranium stock recommendations for Jim’s publications. Phil holds a Bachelor of Applied Science degree, Honours Program, from the University of Guelph.

Natalia Samartseva

Chief Financial Officer

- Natalia Samartseva is a Chartered Professional Accountant with significant experience in public company reporting, IFRS, internal controls and auditing.

- She has held a diverse range of financial leadership positions in companies listed in Canada and the United States and a variety of public accounting practice positions.

- Her consulting work has focused on financial reporting and analysis for junior resource companies.

- Natalia has overseen projects related to internal control improvements implementation, preparation of financial models, forecasts, business valuation models, transitioning from exploration to commercial production stage for mining companies, and other complex accounting and tax issues.

Jack Campbell

Independent Chairman

- Worked as Head of Corporate Communications for Concentric Energy, which was acquired by Uranium Energy Corp. (NYSE:UEC) in 2011.

- Participated as an investor in the uranium cycle of the early 2000s.

- Engaged in financial analysis of public companies within the mineral resource sector for 15 years.

- A Professional Engineer, holds a B. Sc. from the University of Maryland.

Bill de Jong

Director

- Bill de Jong is a lawyer in the Capital Markets group with international law firm DLA Piper (Canada) LLP, with a focus on the natural resources and energy sectors.

- He maintains a practice specializing in the areas of securities (regulatory and stock exchange compliance), mergers and acquisitions (M&A) and corporate finance. Bill acts for issuers and dealers in both domestic and cross-border debt and equity financing transactions and also advises clients in public and private M&A transactions.

- In addition to his private practice, Bill serves as a director on a number of boards for public companies listed on the TSX Venture Exchange, Canadian Securities Exchange, and Cboe Exchange, as well as provides advice to special committees and acts as independent counsel to boards in unique circumstances.

CSE: CAKE

Capital Structure

Latest